Most hospitality industries depend upon travel website or travel agents online. They provide business to business bookings for hotels and they work as middle man but they work in accordance with laws of GST and these needs to be tabled and inducted into Tally or TallyPrime so that proper calculations of CGST and SGST and all of these should be distributed in accordance with laws so that proper calculations of financial transactions needs to be done.

MakeMy trip is an online travel business and it connects travellers into numerous hotels and in addition to this they provide points systems. Most of makemy trip payments are done through make my trip as customer pay to these companies and in return makemy trip keeps some percentages of money and then return back rest of money to hotel. While returning rest of money to hotels in terms of room sale, then output CGST on room and then output SGST on room sale.

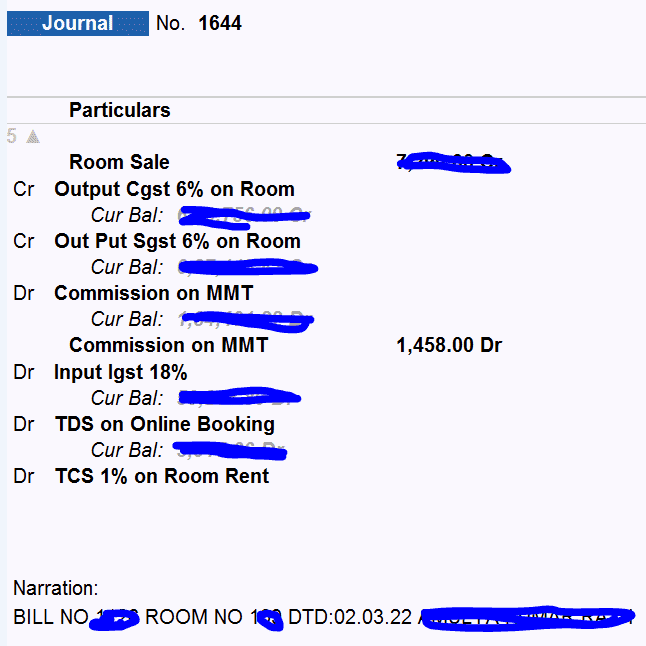

Then commission on make my trip and then input IGST. IGST is the combination of central GST and state GST. MakeMy trip takes commission in terms of IGST, which is combination of central GST and state GST. Then you can add TDS on online booking and then TCS on room rent. Then, in narration you can write bill number, room number and name of guest and date of booking.

TCS is tax collected at source and it is applicable under goods and services tax. Double click on TallyPrime icon on desktop shortcut.

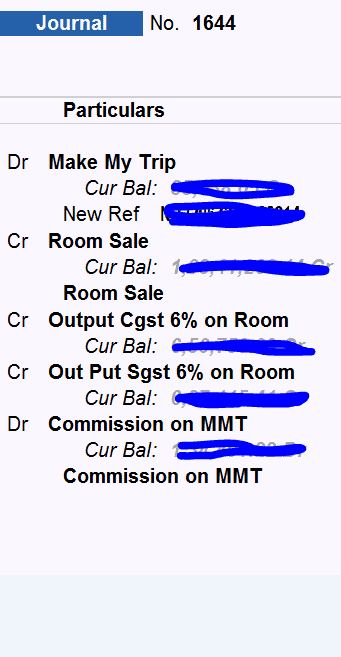

In the debit side of MakeMy Trip journal entry:

- Now you enter TallyPrime.

- From list of companies. Select yours company and then press the financial year and then it will reach to TallyPrime dashboard.

- From list of companies you should not chose companies with edited suffix but you should chose company that has no edited suffix tab select it and then reach to TallyPrime dashboard.

- Click on voucher

- Then click F7 Now enter to JOURNAL

- In the DEBIT segment write down MakeMy Trip and from IDS document find out MMT to pay hotel amount.

- Then from IDS find out commission on MMT (MakeMy Trip) and in Tally prime write down MMT Commission

- In IDS find out GST @18% , and in TallyPrime writedown IGST and put the GST amount of IDS

- In IDS find out TCS (Tax collected at source )and note down its amount on TallyPrime in the header TCS 1% on room rent

- In IDS find out TDS and note down its amount and open TallyPrime in the header TDS on online booking and write down noted amount.

In the credit side of MakeMy Trip journal:

- From Ids entry find out effective hotel price and note down amount and in TallyPrime write that amount in Room Sale

- From the IDS entry note down price 6% of effective hotel price and write down that amount in TallyPrime in the header as output CGST cost 6% on room in the credit side.

- From the IDS find out 6% of effective hotel price and note down price and then open TallyPrime and write down under the head output SGST 6% on room and put the price noted from IDS.

Narration:

In the narration side of TallyPrime put the below mentioned informations in order to know the details of Business to business and name of customer.

- Room No.

- Bill No.

- Name of customer

- Date of check in